The Australian aged care sector continues to grapple with significant financial pressures and operational challenges, as highlighted in the latest StewartBrown Aged Care Financial Performance Survey Report for September 2024. The findings shed light on the sector’s struggles and the potential for future improvements under ongoing reforms. Key takeaways:

Residential aged care: Mounting losses and staffing pressures

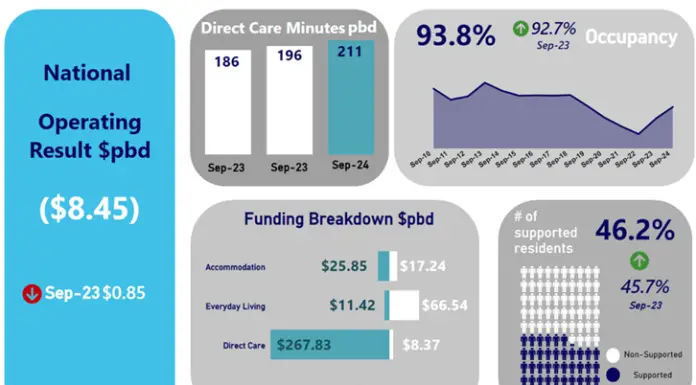

The financial situation for residential aged care homes has deteriorated notably over the past year. The average operating result for homes plunged to a loss of $8.45 per bed per day, a stark contrast to the $0.85 surplus recorded in September 2023. Everyday living and accommodation services continued to weigh heavily on providers, with deficits of $8.02 and $10.75 per bed day, respectively.

The survey found that 59% of aged care homes were operating at a loss, an increase from 50% in September 2023. Alarmingly, 36% of homes reported an EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortisation) loss.

Staffing and care challenges

The introduction of mandatory staffing requirements has added further pressure. Direct care staffing has increased due to the government-mandated 24/7 registered nurse (RN) requirement and the stipulated minimum care minutes per resident per day. On average, homes provided 41.22 RN minutes and 210.54 total direct care minutes per resident daily.

Occupancy and funding

On a positive note, occupancy rates climbed to 93.8%, approaching pre-COVID levels. Additionally, the AN-ACC (Australian National Aged Care Classification) funding rate rose to $280.01 per day from October 2024, reflecting higher direct care minute targets and offering some financial relief.

Home Care: Incremental financial improvement

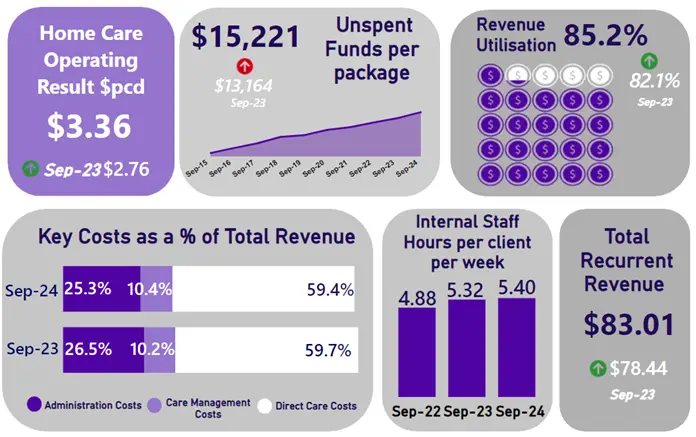

The home care sector showed moderate financial improvement over the past year. Operating results increased to $3.36 per client per day, up from $2.23 in September 2023. Unspent funds per client also grew, averaging $15,221 compared to $13,164 a year earlier.

This growth highlights the potential for better resource utilisation within the home care sector. However, challenges remain, particularly around the effective allocation of unspent funds to meet client needs.

Funding reforms and financial projections

Looking ahead, the StewartBrown report models three potential scenarios for the sector’s financial performance by the 2028-29 fiscal year:

- Current reforms: An estimated operating surplus of $19.36 per bed day.

- Moderate accommodation price increase: A projected surplus of $29.38 per bed day.

- Full accommodation price increase: A potential surplus of $33.58 per bed day.

These scenarios suggest that while reforms hold promise for long-term financial sustainability, their success depends on the sector’s ability to implement necessary changes, particularly in pricing structures.

Persistent challenges and recommendations

Despite progress, key challenges continue to impede the sector’s financial recovery:

- Everyday living and accommodation services remain unprofitable for many providers.

- Facilities in MMM3-MMM5 (Modified Monash Model) locations, representing regional and remote areas, face difficulties attracting necessary capital investment.

To address these issues, the report proposes several critical measures:

- Increase the Hotelling Supplement: Boosting government contributions to accommodation costs could alleviate financial pressure on providers.

- Revise MPIR methodology: Reforming the Maximum Permissible Interest Rate methodology for pricing could improve revenue streams for accommodation services.

- Address labour costs: Developing strategies to manage rising labour costs and ensuring smooth transitions to new funding and staffing models is essential.

While the aged care sector faces immediate financial hurdles, the StewartBrown report points to a more sustainable future if reforms are fully implemented. Increased funding, higher occupancy rates, and adjustments to staffing requirements are expected to enhance sector performance by FY29. However, additional support will be critical for regional and remote facilities, which remain disproportionately affected by financial constraints.