StewartBrown has released a detailed discussion paper on the upcoming Financial and Prudential Standards set to commence on 1 November 2025, raising serious concerns about the impact of the proposed Liquidity Standard on the financial sustainability and future development of Australia’s aged care sector.

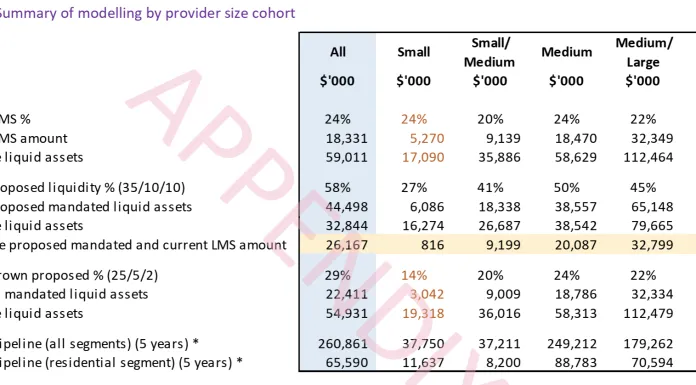

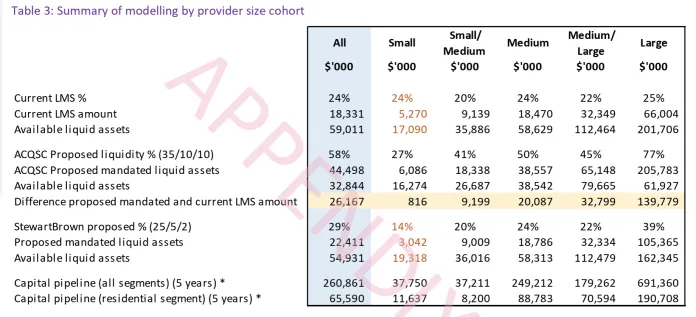

The Liquidity Standard, applying only to residential aged care providers, requires organisations to hold a minimum amount of liquid assets calculated using a fixed formula. This formula mandates 35% of quarterly cash expenses, 10% of Refundable Accommodation Deposits (RADs), and 2% of Independent Living Unit (ILU) liabilities. StewartBrown estimates that this would increase the required liquidity level from a current average of 24% to 58%, a significant shift that may limit investment and innovation.

While the Aged Care Quality and Safety Commission (ACQSC) asserts that more than 80% of providers already meet or exceed these proposed thresholds, StewartBrown warns that the implications of mandating such levels, rather than allowing flexibility based on providers’ risk profiles, could severely restrict developments.

“Large providers, who carry the burden of sector growth, would be disproportionately affected, with mandated liquidity potentially reaching 77%.”

StewartBrown: Discussion paper aged care financial and prudential standards 2025.

The analysis supports a more flexible, risk-based approach, recommending an alternative formula of 25% of cash expenses, 5% of RADs, and 2% of ILU liabilities. StewartBrown also supports allowing providers to submit alternative liquidity assurance based on reliable cash flow forecasting and access to credit.

Importantly, StewartBrown notes that the residential sector remains financially viable despite five years of cumulative operating losses, a pandemic, and staffing shortages. Refundable deposits have consistently exceeded outflows since 2014, and the Aged Care Accommodation Guarantee Scheme has only been triggered 17 times since 2006, refunding less than 0.01% of liabilities.

With major funding reforms also taking effect from 1 November 2025, including a hotel services supplement and RAD retention, the report argues that liquidity risks are declining, not rising.

Overly cautious liquidity mandates could undermine the very investment needed to meet surging demand and improve care quality.