Aveo has released its results for the six months to 31 December 2018 (HY19). Below is its statement to investors.

While the broader property market across large parts of Australia has experienced a significant downturn over the past 18 months, with a decrease in average weighted auction clearance rates for the four major capital cities in which it operates from 72% in the final quarter of FY17 to 42% last week, demand for innovative retirement living remains strong, with Aveo’s sales lead indicators and written sales volumes for HY19 exceeding the same period as last year.

Aveo’s sales in HY19 were steady at an average of 19 written sales per week, while retirement unit pricing remained steady.

However, Aveo Group Chief Executive Officer, Geoff Grady said that the current residential property market remains extremely challenging, which has had an adverse impact in HY19 on Aveo’s time frame for settlements.

“Settlements are taking longer to occur as incoming residents are experiencing increased difficulty in selling their homes. This has led to a substantial increase in the number of our deposits on hand, from 89 at 30 June 2018 to 212 at 31 December 2018. Our underlying profit, at $12 million for HY19, is driven by the number of unit settlements and is a reflection of this broader property market downturn.

“However, typically the delivery profile for settlements is weighted to the second half of the financial year. Our business focus for the second half of FY19 will be on maintaining our written sales rate and settlement of sales.

“On the customer front in HY19, our focus on resident wellbeing remains our highest priority. Aveo’s latest annual resident satisfaction survey revealed that resident satisfaction is at its highest level since 2014, with an

83% positive rating. This tells us that the experience of living in an Aveo retirement property is an overwhelmingly positive one.”

“In addition, the revised Aveo Way contract regime, including the Aveo Certainty contract with its care transfer options, introduced in September 2018 has been well received, giving residents flexibility and choice on how

they structure their entry into an Aveo community.”

Aveo also provided an update on the strategic review, which was announced on 15 August 2018.

Merrill Lynch was appointed as the financial adviser to Aveo in

relation to the strategic review.

Consistently with the process timetable previously disclosed, the first stage of the strategic review process began in late November 2018. In late January 2019, a number of indicative non-binding bids were received from parties

interested in a whole of company transaction.

The Independent Board Committee, together with Aveo’s advisors, are currently assessing those bids and aims to shortlist preferred bidders to take into the second stage of the process, which will commence in late February 2019.

Aveo also continues to explore other strategies to improve value for securityholders, including the continuation of the non-core asset divestment process.

The Board is also considering using free cash flow, which is expected to become available from May 2019 given the timing of cash flow generation, to allocate to the current security buyback. This has the potential to improve Aveo’s net tangible assets per security.

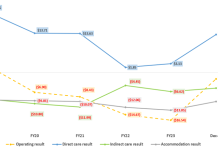

Aveo Group recorded an HY19 underlying profit after tax and non-controlling interest of $12.0 million, down 67% on HY18.

On a statutory basis, Aveo recorded a HY19 statutory loss after tax of $44.7 million, down 130% on HY18. This was driven by a $63.2 million decrease (after tax and non-controlling interest) in the valuation of the Retirement

property portfolio, largely due to lower property price growth assumptions used in determining the value of the portfolio, reflecting the downturn in the broader residential property market in Australia.

The profit on the sale of the last component of the Gasworks complex at Newstead, QLD partially offset the valuation decrease.

The decrease in the value of the Retirement property portfolio was the primary driver for the decrease in Aveo’s net tangible assets per security from $3.92 as at June 2018 to $3.83 as at 31 December 2018.

The key financial results for HY19 include:

• Statutory loss after tax of $44.7 million, down 130%;

• Underlying profit after tax and non-controlling interest down 67% to $12.0 million;

• Earnings per stapled security on underlying profit after tax and non-controlling interest, down 68% to 2.1cents;

• Funds from operations at $1.3 million ($50.9 million in HY18); and

• Net tangible assets per stapled security of $3.83, down 2% from 30 June 2018.

In presenting the updated to investors, Aveo Group Chief Executive Officer, Geoff Grady said:

“The Retirement result decreased by 49% and amounted to 65% of overall divisional contribution. Based on the current average written contracts rate, the previously indicated sales level of 1,150 written sales is regarded as achievable, with some risk.”

“The Retirement Established Business was resilient in HY19, despite the softening of the residential property market with sales leads remaining relatively strong.”

The delivery profile of Retirement Development and Non-Retirement asset settlements are weighted to the second half of FY19 and also affected the underlying profit.

Total Retirement revenue increased by 1% in HY19 to $154.0 million, driven by improved Care and Other Services revenue and partially offset by lower sales volumes of minor development stock, due to settlement delays. Aveo recorded total Retirement settlement volumes of 364 units, down 21% from HY18.

Major development deliveries increased by 60% over HY18, with new units predominantly delivered at Springfield, QLD and Island Point, NSW.

In the Retirement Established Business, the total revenue of $74.2m is up 3% on HY18. The written sales rate of 7.9% outperformed HY18’s rate of 6.6%. Settlement rates have decreased, leading to an increase in deposits on

hand of 120% over HY18. The realised average transaction price point increased by 11% to $402,000 per transaction, and the DMF/CG2 margin percentage remained flat compared to HY18.

Aveo Way contracts continue to be adopted throughout the portfolio, which will contribute to margin growth as those residents sell their units. An additional 134 units are now on Aveo Way contracts, compared to FY18.

Cost management schemes employed in prior periods are taking effect, with overheads in the Retirement Established Business down 11% on HY18.

The decrease in Retirement Development contribution was due to a decrease in the sales rate of minor development Freedom and original conversion units. The average transaction price point increased by 14% to

$577,000 per unit, which reflects the demand in Aveo’s Freedom care services. Both major and minor development margins are within target ranges.

Revenue for Care and Support Services was offset by upfront costs and depreciation associated with the roll out of the new Newstead aged care facility.

Aveo’s care offering has been complemented by the start of the Aveo Care at Home business, expanding the availability of traditional home care services to all Aveo communities.

Non-Retirement assets continue to be sold down in line with the Group’s strategy. The change in profit contribution primarily related to lower land lot sales.

Capacity through Aveo’s undrawn committed lines and cash is expected to increase as commencement of development is delayed until the residential property market improves.

Reported gearing at 19.7% is at the top end of Aveo’s preferred range of 10% – 20% but is expected to reduce to circa 17% – 18% by end of June 2019.

Aveo remains focused on leading the Australian retirement living sector through its commitment to care, innovation and choice for its residents and delivering growth and value to its securityholders. Despite the challenges in the current Australian property market, Aveo’s retirement living product remains attractive and demand for it is strong.

Aveo management remains focused on delivering value in FY19 by:

• Converting written sales into settlements from the increased level of deposits;

• Delivering 419 major development units in FY19;

• Progressing the strategic review process to bridge the value gap for securityholders; and

• Reviewing the free cash flow position and considering value adding options, such as continued buybacks of shares.

The Board reaffirms its target full year distribution based on 40% – 60% of underlying profit.