Regis Healthcare (ASX: REG) will acquire four high-quality aged care homes from Rockpool Residential Aged Care in a $135.5 million deal, set to be completed on 1 September. The acquisition will add around 600 beds to Regis’ national network and significantly strengthen its footprint across Southeast Queensland.

The transaction includes the purchase of fully operational homes at Morayfield, Carseldine, Pelican Waters, and Songbird Oxley. The deal excludes the Rockpool brand and three development-stage sites, including Northshore Hamilton, Kedron, and another unnamed project.

“This acquisition aligns with our strategy to broaden our residential aged care footprint through premium home acquisitions.”

Regis Managing Director and CEO Dr Linda Mellors

Regis will assume Refundable Accommodation Deposit (RAD) liabilities of approximately $204 million, with expected net inflows of around $40 million as the Oxley home, opened in March, ramps up from its current 53% occupancy.

Founded in 2016 by Bill Summers and Michael Watson, Rockpool Aged Care has built a strong reputation for quality care and innovative, hotel-style facilities. CEO Melissa Argent called the sale a “day of mixed emotion,” acknowledging the pride in what the organisation has built while highlighting the opportunity to recapitalise and expand.

“For us, it’s about being able to recapitalise and keep moving forward,” said Argent. “This sale will allow Rockpool to focus its efforts on building even more beautiful aged care homes across Southeast Queensland.”

Ms Argent confirmed that frontline staff at the sold homes will be retained under Regis, although some corporate roles may be impacted. Construction continues at Rockpool’s Northshore Hamilton site, due for completion in mid-2026, with work at Kedron scheduled to begin in September this year.

Post-acquisition, Regis will operate 72 freehold homes across Australia, with a total of approximately 8,200 beds. It forecasts annualised pro-forma EBITDA of $13–14 million once Oxley is fully operational, and FY26 reported EBITDA of $7–8 million.

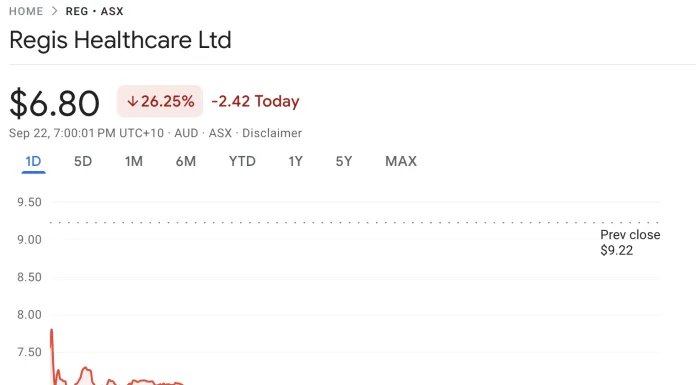

At market close on 25th July 2025, Regis shares (ASX: REG) were up 3.5%.