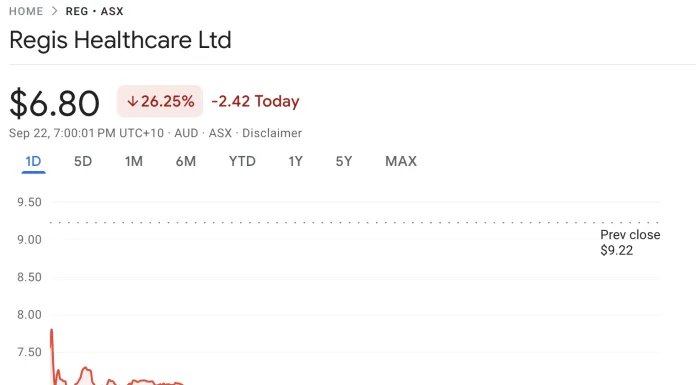

Shares in Regis Healthcare (ASX: REG) tumbled 26% to $6.80 at the close of trading today, after the aged care operator warned that recently announced government funding changes would fall short of its expectations, tightening margins in the face of rising wage pressures. Despite the fall, the stock remains up over the past 12 months.

The government confirmed on 12 September that the Australian National Aged Care Classification (AN-ACC) industry starting price would increase 4.7% from 1 October, alongside a rise in the Hotelling Supplement from 20 September. However, Regis said its own modelling suggests it will only receive a 2.6% funding uplift.

The gap stems from the reweighting of the National Weighted Activity Unit (NWAU), which reduced funding across several key resident classifications. Regis said the shortfall will be compounded by higher staffing costs linked to the Fair Work Commission’s Work Value Case, the Annual Wage Review, and enterprise agreement increases. The operator added that the Hotelling Supplement increase will be entirely absorbed by additional staffing expenses.

The recent AN-ACC increase is designed to support higher wages for direct care workers and nurses, but Regis warned it will not sufficiently offset the upcoming cost increases.

Despite the funding challenge, Regis confirmed it had completed the acquisition of four Rockpool homes on 1 September and reported mature spot occupancy of 96.5% across ~7,900 beds as at 18 September. Net refundable accommodation deposit (RAD) inflows remain strong, underpinning cash flow and growth initiatives.

Looking ahead, the company expects FY26 underlying EBITDA to be in the range of $130 million to $135 million, representing 3% to 7% growth on FY25, buoyed by the Rockpool acquisition and ongoing trading performance. However, Regis flagged that the pace of greenfield developments could be delayed.