Private Equity giant Bain Capital (the same people that bought Virgin Australia out of administration) have tabled a non-binding $3.00 per share for the aged care operator.

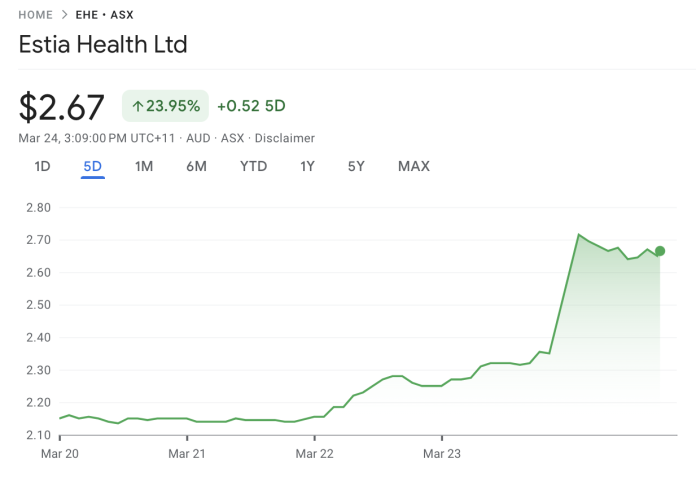

Estia Health Limited (ASX: EHE) has confirmed in a release to the ASX earlier today that it has received an indicative proposal from Bain Capital to acquire all of its shares by way of a scheme of arrangement. This follows recent media speculation about potential takeover interest and a mystery acquirer buying shares over the last two days that has seen the share price spike.

Under the terms of the proposal, Estia Health shareholders would receive A$3.00 cash per share, adjusted for any dividends paid or payable after the date of the proposal. However, the proposal is subject to a number of conditions, including the satisfactory completion of due diligence on an exclusive basis, a unanimous recommendation from the Estia Health Board of Directors, and approval from various regulatory bodies.

Estia Health has stated that it is currently assessing the proposal with its financial and legal advisers to determine whether it is in the best interests of shareholders to engage with Bain Capital. There is no certainty that the proposal will result in a binding offer, or that any transaction will eventuate.

Estia Health also confirmed that it was not aware of the identity of the party or parties who had acquired shares in the company over the preceding two days.