Estia Health Limited (ASX: EHE), has announced a significant milestone in its acquisition journey by entering into a Scheme Implementation Agreement (SIA) with an entity controlled by Bain Capital, LP. The SIA outlines the acquisition of 100% of Estia Health’s issued share capital through a scheme of arrangement, adhering to the Corporations Act 2001 (Cth). The full ASX release can be found here.

Key Highlights:

- Bain Capital and Estia Health have reached an agreement for the acquisition through a Scheme of Arrangement.

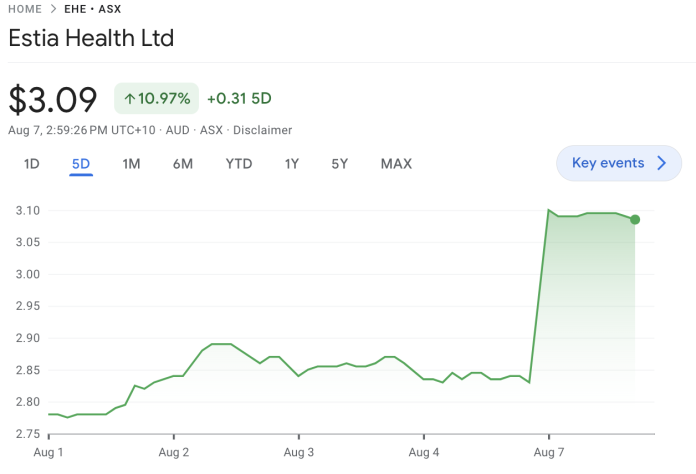

- The proposed Scheme Consideration entails $3.20 per Estia Health share in cash, adjusted for permitted dividends.

- The offer represents a substantial 50% premium to Estia Health’s closing share price of $2.14 on March 21, 2023.

- Estia Health holds the option to pay fully franked dividends of up to $0.12 per share, allowing eligible shareholders to gain around $0.05 per share in additional benefits through franking credits.

- The Board of Estia Health recommends shareholder approval for the Scheme, subject to the Independent Expert’s conclusion and the absence of a superior proposal.

Scheme Implementation and Details: Should the scheme proceed, Estia Health shareholders will receive $3.20 per share, with adjustments for dividends issued after the SIA’s execution. Estia Health is permitted to provide fully franked ordinary dividends of up to $0.12 per share. This could potentially grant eligible shareholders additional benefits through franking credits, based on their tax circumstances.

The scheme’s valuation implies an equity value of approximately $838 million and an enterprise value of around $959 million, showcasing a significant premium to various share price metrics.

Board’s Recommendation: The Board of Estia Health has advocated for shareholders to vote in favour of the Scheme, contingent on the Independent Expert’s continuous endorsement of the deal as being in the best interests of Estia Health shareholders.

In a statement to the ASX, Dr Gary Weiss, Estia Health Chair, expressed the company’s value recognition and confidence in the future outlook. He highlighted the scheme as an opportunity for shareholders to realise cash value promptly.

Estia Health CEO, Mr Sean Bilton, emphasised that Bain Capital’s interest underscores Estia Health’s commitment to exceptional care and support for stakeholders.

Next Steps: The scheme’s implementation hinges on various conditions, including Estia Health shareholder approval, regulatory clearances, court approval, and other customary requirements. A comprehensive Scheme Booklet, including relevant information and an Independent Expert’s report, will be provided to shareholders.

Shareholders will vote on the Scheme at an expected shareholder meeting in November 2023. Pending requisite approval and fulfilment of conditions, the Scheme is projected for implementation before the end of 2023.