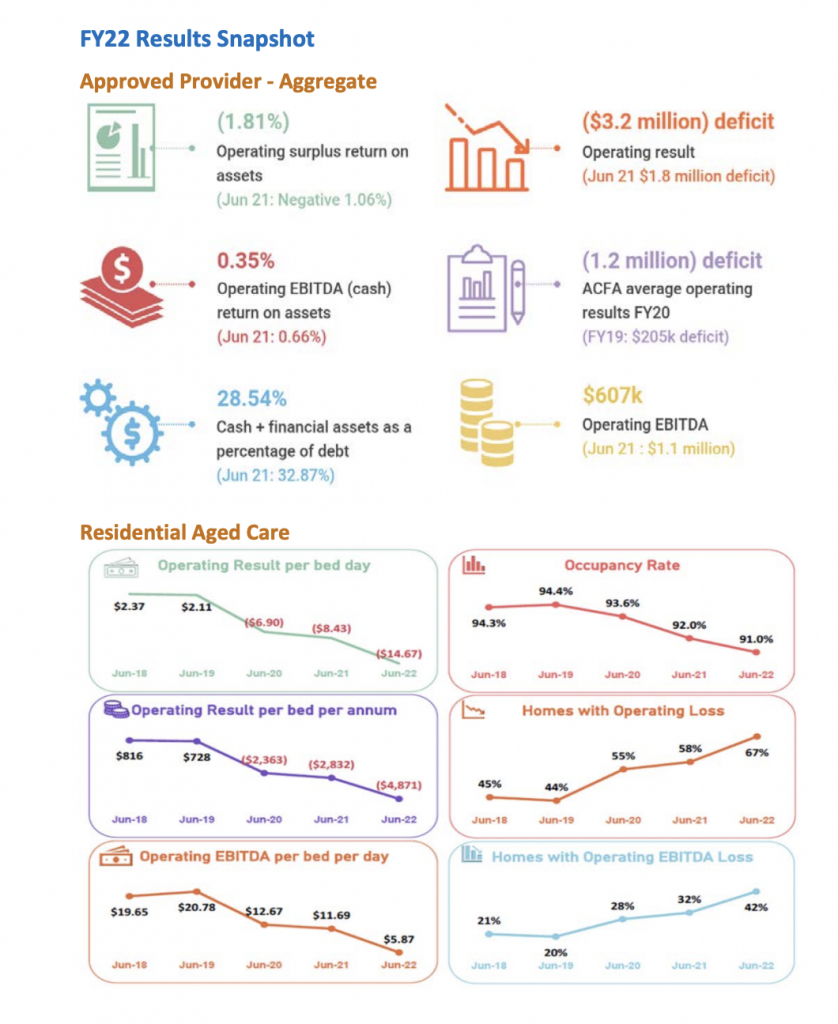

The latest Stewart Brown Survey for the June 22 quarter – assessing about half of Australia’s aged care homes – provides sobering news across just about every metric.

In total, 1,313 aged care homes (106,035 beds/places) and 75,783 home care packages were assessed across Australia. This doesn’t include government-owned facilities or publicly listed entities that include Estia Health (ASX: EHE) and Regis Healthcare (ASX: REG), who have seen their circa $500m market capitalisations fall by 9.28% and 16.18% respectively year on year. (at the time of writing)

Inside Ageing spoke with a director of an NSW-based regional aged care provider who commented that they are waiting to see if AN-ACC delivers an uplift to their numbers, with uncertainty as to whether this will translate to the reported 10% increase per resident. They also commented and welcomed funding to carry out capital works that are currently underway – monies received from the 2020 Aged Care Approvals Round where regional providers benefited most.

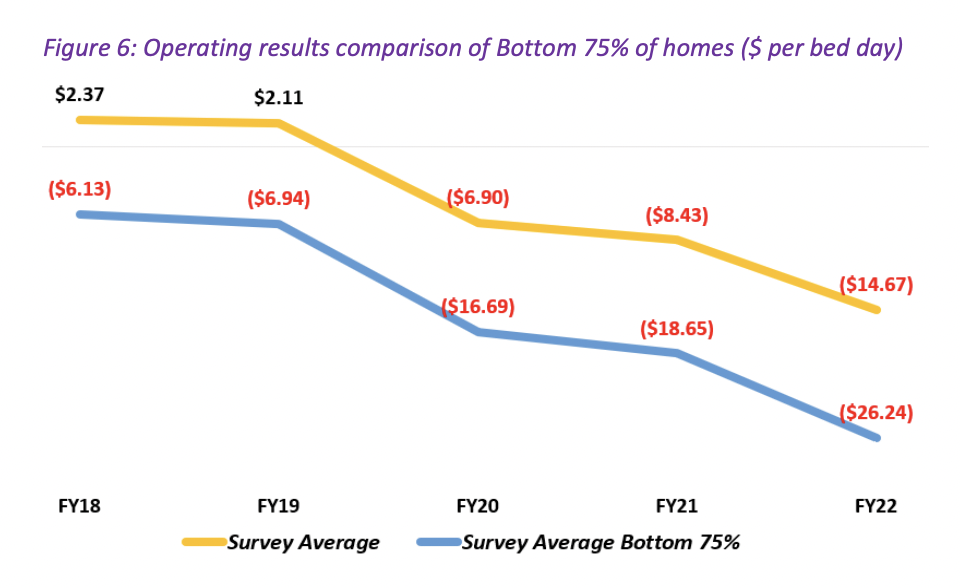

The average operating results for residential aged care homes in all geographic sectors was an operating loss of $14.67 per bed day (FY21 $8.43 pbd loss) despite the additional Basic Daily Fee supplement of $10 per bed day.

The report cites the accumulation of some 5 years of operating losses in the residential aged care space and suggests that an emergency funding package should be considered in the short term to allow for necessary funding reforms to be flowed through.

This uncertainty, especially when it comes to financial sustainability was echoed in a recent interview Inside Ageing did with Jason Binder of Respect Aged Care who operates 16 facilities, with many in regional parts of NSW, Victoria and Tasmania. Below is a quote from that interview, with the full interview available here.

“We’re probably at the bottom of the residential aged care market swing now and whilst we were profitable last year and we’ve always been in the top 25% of financial performance, it’s getting tight even for us, so it would be nice to have some offset to that because the next two to three years are going to be difficult with so many changes to income and cost structures. If anyone was certain about profitability in residential aged care over the next two or three years I’d be cautious of that person’s advice. No one knows, not even the Government because there are so many changes the Government need to implement, that they just have to see what happens to profitability and adjust funding as we go. I don’t think they have any other option because if they overfund it they’d have private provider Directors driving around in Ferraris and buying mansions as they did in the early to mid-2010s.”

The Stewart Brown report makes special mention of those providers in the bottom 75% who are performing well below the industry average as shown in this graph.