The latest StewartBrown Analysis Report on aged care performance for the 6 months to December 2023 has been released. It analyses data from 1203 aged care homes/98,902 beds, and 73,829 home care places from 223 approved providers.

The results on the residential aged care sector reveal both improvements and persistent headwinds.

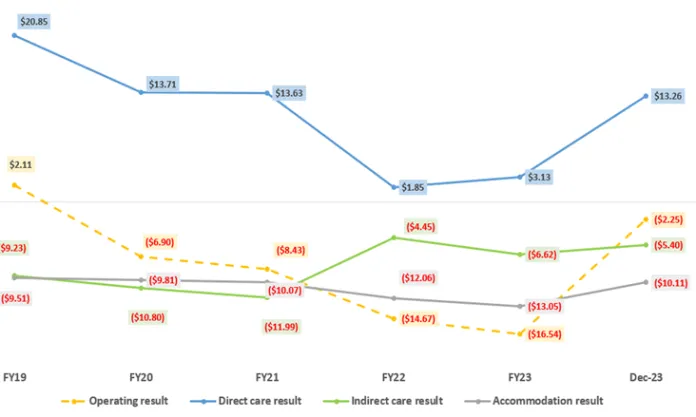

Despite an enhanced EBITA surplus of $6,028 per bed per annum, residential aged care facilities face a deficit of $2.25 per bed day, influenced by increased AN-ACC margins and higher occupancy rates.

However, 52% of homes operate at a loss, and 31% experience cash deficits, highlighting ongoing financial strain exacerbated by deficits in consumer contributions for daily living and accommodation services.

The Fair Work Commission’s Stage 3 decision introduces wage increases for indirect care workers, with significant implications for staffing costs. The sector continues to struggle to meet targeted registered nurse (RN) minutes due to staffing shortages, leading to reliance on costly agency RNs. Projections for FY24 forecast a slight increase in deficits, indicating continued financial challenges despite increased direct care funding.

Indirect care, including hotel services, faces a $5.40 per bed day deficit, exacerbated by high costs and limited revenue. Similarly, accommodation remains a significant loss-making area, with an average deficit of $10.11 per bed day, despite initiatives to improve financial sustainability.

Evaluating economies of scale, larger providers demonstrate higher operating results and adjusted operating results, albeit with higher direct care costs. Smaller providers face greater financial challenges, with opportunities for cost savings through efficient care minute allocation.

Addressing these financial complexities requires a multifaceted approach, including adequate government subsidies, consumer contribution reforms, and strategies to enhance operational efficiency and revenue generation. Additionally, recommendations from the Aged Care Taskforce, such as retention components for RAD payers, aim to improve sector sustainability.

Home Care

In home care, there’s a positive surplus of $2.69 per client per day, with revenue totalling $76.08 per client per day. However, revenue utilisation stands at 82.7%, indicating a notable portion of available funding remains unused. Unspent funds per consumer are high, averaging $13,963, contributing to an overall excess of $3.7 billion in unutilised funds. These inefficiencies highlight the need to improve revenue utilisation for the sector’s financial sustainability.

Despite the surplus, challenges persist, with staffing hours for direct home care services decreasing to 5.37 hours per client per week, significantly below pre-consumer directed care levels. Consumer contributions remain low, comprising less than 2.6% of the overall funding envelope. These factors highlight the importance of addressing operational inefficiencies and enhancing revenue utilisation to optimise the delivery of home care services and ensure the sector’s long-term viability.