Japara Healthcare Limited has announced its results for the year ended 30 June 2017, achieving EBITDA of $60.2 million which Chief Executive Andrew Sudholz has described as a “solid result…in a sector currently experiencing on-going regulatory reform”.

Its overall result is up 7.3 per cent on FY16, while revenue is up 10.7 per cent to $362.2 million (FY16: $327.3 million). Overall net profit after tax was down 2.3 per cent to $29.7 million (FY16: $30.4 million), which has been attributed to land purchases, refurbishments and brownfields developments.

The company’s key operational metrics show:

- Operational places increased by 3.3 per cent to 3,841

- Average underlying occupancy remained about the same at 94.6 per cent (excluding

- Average revenue per day increased by 3.3 per cent to 281.9

- Staffing costs increased by 1 per cent to 68.1 per cent of total revenue

- Non-wage costs decreased slightly from 15.7 to 15.3 per cent

- The number of average concessional residents increased by 1.7 per cent, taking total figures to 38.5 per cent

The biggest revenue change for Japara was an increase in average incoming bed contract prices by 8 per cent from $320,000 to $345,500. Average bed contract prices for the second half of the year were just over $350,000 and the company warns they will continue to increase as its developments are in “optimal metropolitan locations”.

In addition to increase room rates, a 1.5 per cent increase in net RAD/ Bond and ILU loan inflow generated an additional $800,000.

During FY17 Japara completed extensive brownfield developments delivering 124 premium rooms with a further 179 in progress. It now has land secured for 11 greenfield projects due to deliver an additional 1,100 new beds by June 2020.

The majority of these projects are in Victoria with six in Melbourne (Glen Waverley, Rye, Newport/Williamstown, Mount Waverley, Reservoir and Lysterfield), one in Geelong, one in Sydney (Belrose) and two in south east Queensland (Robina and Mitchelton).

It also commenced a significant refurbishment program upgrading 14 facilities over the next two years.

In the retirement village space, Japara is planning an additional 200+ ILUs & ILAs across three locations adjoining existing residential aged care facilities.

Group earnings will be increased through development profit and Deferred Management Fee (DMF) income.

In the company’s ASX announcement, Executive Officer, Andrew Sudholz, said: “This is a solid result, delivering revenue and EBITDA growth in a sector currently experiencing on-going regulatory reform. We have continued to provide excellent care and services to our many residents and execute against our growth strategy to provide new and improved homes for Australia’s ageing population.”

“Excellent progress has been made on our developments program with four extensive brownfield projects completed delivering 124 new places. We currently have 16 brownfield and greenfield projects underway. Our greenfield home, Riverside Views in Launceston, Tasmania has just completed and is due to open in late September 2017.”

“Japara Healthcare continued its good record of strong cash generation during the year and with a strong balance sheet and available liquidity of circa $190 million, it is well positioned to support future growth.”

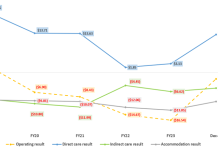

Sudholz says the company’s outlook at least for the next two years is about the same, with EBITDA expected to increase from FY19 as greenfield developments complete and ACFI indexation increase recommence.

While no reference was made to the uncertainty surrounding future ACFI changes, Japara’s shares still dropped yesterday from $2.02 to $1.75 following the ASX announcement of its year end results.

An investor and analyst briefing on the FY17 results is available at the Investor Centre on Japara Healthcare’s website.